Catharine Murphy likes to ship her family and friends e-gift playing cards — for particular events, to mark a vacation, simply say thanks, or to make up for lacking a milestone.

“I am the one who will all the time want you a belated birthday,” she stated with amusing, throughout an interview at her dwelling in Oakville, Ont.

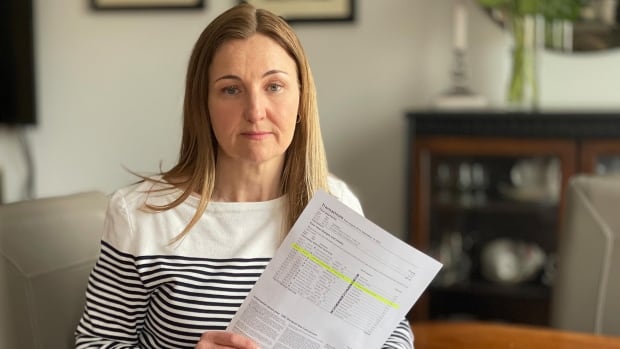

However final November as she reviewed her CIBC Visa bank card assertion, Murphy observed a further $5 cost beneath a $10 Tim Hortons present card she’d bought for a son who’s away in school.

She additionally noticed one other $5 cost for a second $10 Tim Hortons present card Murphy had bought for her daughter.

Curious, she dug out her October Visa assertion and found the financial institution had additionally dinged her $5 when she purchased a $25 Starbucks e-gift card for a pal that month. A present card she bought in August didn’t have the additional charge.

Murphy referred to as CIBC to inquire concerning the additional prices and after a prolonged dialog with a customer support rep discovered they have been “money advance” charges, charged each time anybody bought a present card that’s bought by an organization referred to as CashStar.

That third occasion firm sells present playing cards on-line or by way of an app for greater than 300 firms — a lot of them common manufacturers comparable to Tim Hortons, Starbucks, Finest Purchase, House Depot, Lululemon and Sephora.

Murphy stated it was “infuriating” to see a $5 money advance charge on the acquisition of a present card — a charge that was accruing curiosity from the day of buy at a charge of twenty-two.99 per cent — not the same old 19.99 per cent charged on common purchases provided that the month-to-month bank card steadiness is not paid off.

On prime of that, she says the CIBC rep could not clarify who was accountable for the cost — the financial institution itself, or CashStar.

Regardless of having her name escalated to a senior supervisor and calling again just a few days later, Murphy says she could not get any readability about who was accountable for the costs.

Transparency essential to clients

That lack of readability is what shoppers discover most irritating, particularly when the large banks are making document income, says a professor on the College of British Columbia’s Sauder College of Enterprise.

“They need to be upfront with what it’s shoppers are paying,” stated Murali Chandrashekaran, who makes a speciality of advertising and marketing and behavioural science. “It is the transparency that is extra essential than the precise pricing itself.”

When Go Public requested CashStar concerning the money advance charge, a spokesperson stated in a written assertion that the corporate doesn’t cost any further charges, and that any money advance charge could be “charged by the bank card issuer.”

CIBC declined an interview request, however in a press release a spokesperson stated, “some present playing cards bought by means of third-party sellers are handled as cash-like transactions which may end up in a money advance charge.”

When Go Public requested the spokesperson for clarification, he stated the charge was triggered by the transaction codes on some e-gift playing cards — however would not say why the cost instantly kicked in final fall.

The financial institution stated CIBC has now determined to scrap the charge, and will likely be routinely refunding money advance prices for patrons who used bank cards to buy e-gift playing cards between Sept. 29, 2023 and Feb. 29, 2024.

The spokesperson declined to elucidate the rationale for the financial institution’s about-face.

Indignant clients query CIBC

Murphy has loads of firm on social media boards comparable to Reddit, the place individuals with CIBC Visas, CIBC Credit cards and CIBC-owned Simplii bank cards have all observed the $5 charge on their statements after buying e-gift playing cards.

Many reported that after ready on the cellphone for as much as an hour, a CIBC customer support rep agreed to refund the $5 charge as a one-time goodwill gesture.

That is what a CIBC rep informed Murphy, too, when she referred to as her financial institution concerning the three $5 charges. The primary agent she spoke to stated she was solely licensed to refund one of many additional charges.

“If I had been pressed for time on that day, I might have needed to accept that,” stated Murphy. As an alternative, she escalated the decision and acquired all three refunded.

Enterprise professor Chandrashekaran says whereas a refund is sweet, his analysis reveals that what individuals need most is to be handled pretty, to listen to a real apology from an organization and a promise that it will not occur once more.

“The issue is that most of the time, firms will say, ‘OK, we’ll reverse this $5 {dollars}, however we’ll do that simply this as soon as’ — as in the event that they’re doing us a favour, and that demeans us,” he stated.

“That lack of respect hurts the very basis of belief.”

Regardless of individuals like Murphy and others complaining to CIBC concerning the charge as early as final September, the financial institution continued to cost the “money advance” charge.

Doable Competitors Act violations

Go Public reviewed CIBC’s Cardholder Settlement, which amongst different issues, spells out what charges clients will likely be charged for numerous providers when utilizing their bank card. There was no point out of present playing cards.

CIBC says a “money advance” applies when utilizing a bank card to withdraw cash at a monetary establishment or ATM, making a invoice fee with a bank card, or when transferring funds.

It says a “cash-like transaction” applies when utilizing a bank card for a transaction “that’s just like money” or shopping for an merchandise that’s “convertible into money,” comparable to lottery tickets.

When requested why present playing cards aren’t talked about within the settlement, CIBC stated it contains examples which can be “illustrative” of what may immediate a money advance charge.

As clients should not capable of convert the e-gift playing cards in query into money, the acquisition shouldn’t be hit with a “money advance” charge, stated Chandrashekaran. What’s extra, he says, including an sudden charge to a purchase order could also be a violation of the Competitors Act.

College of British Columbia enterprise prof Murali Chandrashekaran provides recommendation for CIBC clients who wish to guarantee they get the promised refund for $5 ‘money advance’ charges on e-gift card purchases.

Two years in the past, the federal authorities strengthened client protections within the Competitors Act, to strive to make sure the worth Canadians see for a product is the one they pay.

“When a worth is unattainable, as a result of shoppers should pay further prices or charges to purchase a services or products, it impacts their talents to make knowledgeable selections,” reads an excerpt on the Competitors Bureau’s web site.

CIBC does not promote the present playing cards, stated Chandrashekaran, however there’s “zero transparency” about why they prove to value greater than what the client anticipated to pay.

“It is as much as shoppers to determine whether or not they wish to embrace this $5 or not,” he stated. “Customers have been by no means given the chance to choose out of this example.”

CIBC didn’t reply to Go Public’s request to touch upon the charge being a potential violation of the Competitors Act.

Financial institution charges value Canadians billions: skilled

The charge CIBC was charging is simply the most recent in a protracted record of financial institution charges Canadians dislike, stated Chandrashekaran.

And now a report launched in February by enterprise consulting agency North Economics says Canadians pay “considerably greater” charges than many individuals in different international locations.

The report estimates that Canadians might save $8.5 billion a 12 months in financial institution charges — about $250 per grownup — if banking regulators had a contest mandate, as exists in international locations such because the U.Ok. and Australia.

CIBC was charging its bank card clients a $5 money advance charge for e-gift card purchases till Go Public acquired concerned.

“In Canada … no regulator is de facto listening to how aggressive the banks are performing between one another,” stated economist Alain de Bossard, managing director of North Economics, including that the banks typically appear to exhibit extra co-ordinated than aggressive behaviour.

“Definitely I believe there are issues that the federal government can do to enhance the state of affairs for Canadians,” stated de Bossard.

Murphy says the expertise has modified how she outlets.

The final time she gave a pal a present card, as an alternative of shopping for one on-line, she drove to a retailer to buy it and personally dropped it off.

“I’ve not despatched an digital present card to anyone since I’ve had this run in,” stated Murphy. “It was a blatant instance of the financial institution benefiting from individuals.”

Submit your story concepts

Go Public is an investigative information section on CBC-TV, radio and the net.

We inform your tales, make clear wrongdoing and maintain the powers that be accountable.

When you have a narrative within the public curiosity, or for those who’re an insider with data, contact [email protected] together with your title, contact data and a short abstract. All emails are confidential till you determine to Go Public.

Learn extra tales by Go Public.

Examine our hosts.