Value of Dwelling9:05Why instalment loans are the riskiest guess in finance

Jolene Chateauneuf was simply attempting to keep away from getting evicted.

It was 2021, and he or she was quick $1,500 for the hire on her house in Princeton, B.C., the place she was residing on the time. So she took out a speedy mortgage from a payday-style lender and gave the cash to her landlord.

Fast loans are generally known as instalment loans, to distinguish them from conventional payday loans, which — because the title implies — are paid again in a single lump sum when the borrower’s paycheque arrives.

In the previous few years, speedy loans have turn out to be widespread as most provinces cracked down on predatory payday mortgage practices, prompting various lenders to as a substitute provide bigger loans with longer cost durations.

The primary few instances Chateauneuf picked up a speedy mortgage, she was capable of pay it again, she advised Value of Dwelling. However when she received behind on funds, and so they had been despatched to assortment businesses, she’d apply for brand new loans to cowl the shortfall so she may be certain that her household had a roof over their heads.

I would just Google ‘instalment loans. No credit score verify.’ … It is tremendous, tremendous simple.– Jolene Chateauneuf

When she fell behind with one lender, it was simple sufficient to search out one other.

“I would just Google ‘instalment loans. No credit score verify.’ … Like, it is tremendous, tremendous simple. And you will get the cash that day, like, inside half a day at the least.”

In the present day the 28-year-old mom of two younger kids is sinking underneath about $50,000 in debt from speedy loans, mixed with scholar loans and automotive funds.

“The most important subject was the rate of interest, which is 46.9 per cent…. So principally you have to pay again your complete mortgage plus one other half of it, which is not possible,” stated Chateauneuf, who’s at the moment residing in Calgary however hoping to return to Princeton, the place the rents are decrease and the pay she will be able to get as a health-care assistant is increased.

“My credit score rating was once excellent, and now it is, like, 395, which is loopy. I’ve so many issues in collections as a result of I simply could not pay the instalment loans, which put my bank card behind. And I’ve all the time been good with my bank card, too, and I simply could not sustain with something.”

Ottawa proposes reducing prison rate of interest

The federal authorities has now proposed regulatory modifications that may decrease the prison charge of curiosity from the equal of 47 per cent annual share charge (APR) to 35 per cent APR.

However credit score counsellors and poverty activists say addressing the basis causes — earnings that hasn’t stored tempo with the price of residing and lack of entry to truthful credit score for low-income earners — are the one issues that can assist stop individuals from turning to no matter mortgage choices can be found, authorized or in any other case.

“Individuals are desperation borrowing, and that is one notch wanting loan-shark stuff,” stated credit score counsellor Scott Terrio, supervisor of client insolvency at Hoyes, Michalos & Associates in Toronto.

Terrio stated he and his colleagues have “a front-row seat to client debt.” Within the final two or three years, he stated, they’ve seen a “dramatic enhance” in individuals whose debt troubles stem from speedy loans.

In 2022, 53 per cent of insolvencies filed by the agency included at the least one speedy mortgage, up from 21 per cent in 2011.

Courtney Mo, director of group impression for Momentum, a Calgary-based charity that helps individuals prepare for employment alternatives and handle their cash, stated the problem of instalment loans has lately turn out to be “unignorable.”

“We found that so many individuals residing on a low earnings had been and are taking out instalment loans and different varieties of fringe loans to make ends meet,” she stated.

In June 2023, a survey from the Monetary Client Company of Canada, a federal authorities company that enforces client safety laws, discovered that 3.6 per cent of respondents from a consultant pattern of Canadians had used a web based lender or payday mortgage firm in the course of the survey interval. The survey was performed on-line and by telephone between August 2020 and December 2022, amongst a consultant month-to-month pattern of about 1,000 Canadians aged 18 years or older.

Each province besides Manitoba has lowered the utmost authorized value of a payday mortgage up to now seven years, in an effort to guard debtors from predatory lending practices. In Alberta, that occurred in August 2016, when Invoice 15, An Act to Finish Predatory Lending, got here into impact.

When that minimize into the revenue margins of fringe lenders, Mo stated, they virtually instantly moved to advertise and promote instalment loans as a substitute of payday loans. “And instalment loans are often a lot bigger, greenback worth, like generally $5,000 or extra. Whereas payday loans will be, you understand, $500, $1,000 perhaps.”

Terrio stated the lenders give out these loans realizing the borrower already has present debt.

“So the individual is already carrying $30,000 in bank card debt or one thing — and it is there on the credit score report, proper, for all to see — and right here you go. Here is one other 15 grand or 10 grand at 48 per cent curiosity.”

Various lenders say they assist the ‘unbanked’

In an e-mail to CBC Information, the Canadian Client Finance Affiliation, which represents various lenders, stated they cost these charges as a result of they tackle a variety of threat by offering unsecured loans to individuals who cannot in any other case entry capital attributable to poor credit score or low earnings. The group added that as much as 25 per cent of debtors default on these loans.

The assertion additionally stated that greater than one-quarter of Canadians are “unbanked.”

“Because of this whereas the bulk have a checking account, they don’t qualify for a bank card, line of credit score, mortgage or mortgage.”

Terrio stated these lenders are successfully enjoying the percentages. “As a result of I assume most individuals pay them again, or at the least pay them again lengthy sufficient for them to make every kind of cash.”

However altering the foundations on how a lot curiosity various lenders can cost will not do sufficient to repair the explanations individuals go to them within the first place, he stated.

On the root of issues, Terrio stated, persons are actually dealing with an earnings drawback slightly than a debt drawback, “as a result of a variety of this would not be in place if individuals had been paid correctly for what they do, and you possibly can afford to stay a good life like all people did 20, 30 years in the past.”

Lots of this would not be in place if individuals had been paid correctly for what they do, and you possibly can afford to stay a good life…– Scott Terrio, debt counsellor

As soon as-in-a-generation inflation, rate of interest hikes, the COVID-19 pandemic and a housing affordability disaster have made it more durable for therefore many individuals to get by, he stated.

Whereas these issues are complicated to deal with, regulatory modifications that make it more durable for customers to qualify for these high-interest loans may assist stop individuals from getting in too deep, Terrio stated.

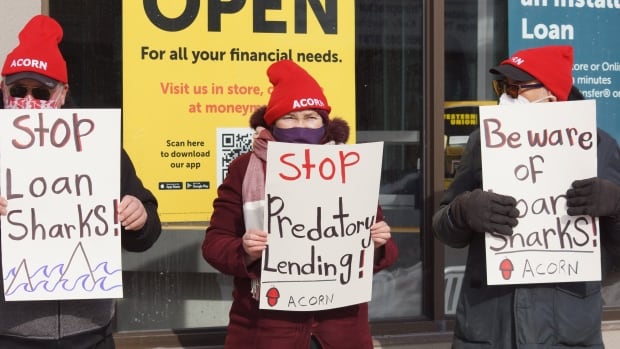

ACORN, a nationwide anti-poverty group, is pushing for the large banks to make extra monetary merchandise accessible to low-income individuals and for the federal authorities to create a good credit score profit, administered by a non-profit or a group growth group, in order that low- and moderate-income persons are not pressured to depend on predatory lenders.

The affiliation that represents Canadian credit score unions put out a report in 2021 on ways in which a few of its members have developed payday mortgage alternate options for the “financially excluded.”

Various lenders ‘in every single place you look’

Within the a part of Mississauga, Ont., the place Marcia Bryan lives, there isn’t any scarcity of locations to get a speedy mortgage.

“You are taking a step throughout the road, there’s about 4, 5, six of them,” she stated. “In every single place you look, they’re proper there, and the place I stay is a lot of the lower-income households.”

Bryan stated when she sees individuals lining up, “I simply need to take a bullhorn and simply get them to get a hell out of there, as a result of they’re susceptible. I have been there, so I do know what it is like.”

A mom and grandmother who lives on funds from the Ontario Incapacity Help Program and a small amount of cash she makes catering on the facet, she took out an instalment mortgage when she wanted to assist household again in Jamaica.

A few years in the past, Bryan used a debt consolidation service to assist dig herself out of $12,000 in debt, principally from speedy loans, after realizing her excessive month-to-month funds had been going to curiosity alone, whereas the stability by no means went down.

Nonetheless, she stated she understands why persons are strolling by means of the brightly colored doorways of other lenders.

“The best way the financial system is true now, whenever you receives a commission, it is both your hire or groceries,” Bryan stated, noting that folks really feel pressured to go to various lenders as a result of “the financial institution is just not lending you something.”

Stress is mounting on the federal authorities to cap rates of interest on payday cash lenders, which may cost almost 50 per cent curiosity. Advocates say it’s typically essentially the most financially susceptible utilizing them and the pandemic financial system has made issues worse.