Fb Market is being flooded with scammers who’re fooling Australians into handing over their hard-earned money, and the worth of losses incurred has tripled in only a yr.

Information.com.au has spoken to quite a lot of sellers who depend on the platform to dump family items, furnishings, second-hand clothes, arts and crafts, and undesirable home equipment.

Every consumer has encountered a military of persistent con artists – some to an excessive diploma – and have grown pissed off with what they see as a scarcity of motion by the social media big.

And a trusted banking platform that’s meant to extend security and safety is on the centre of it.

By no means been worse

Over the previous decade, Emilia Rossi has bought 1000’s of things through Fb Market in addition to related shops like Gumtree and eBay.

She’s encountered her fair proportion of dodgy operators and scams in consequence, however the Melbourne marketer has by no means seen issues fairly so dangerous.

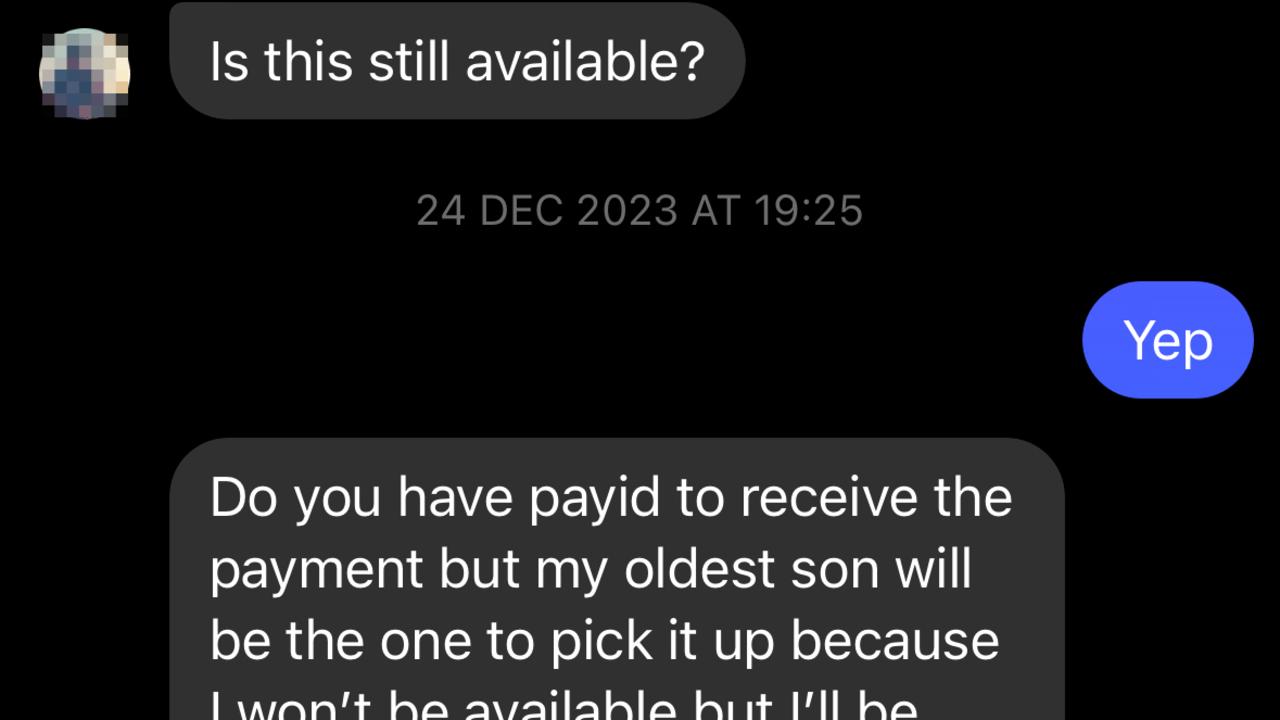

In current instances, the commonest con try on Fb includes the PayID system, a mysterious relative, and a reasonably convincing script.

“There’s a rising concern about PayID-style scams as on-line marketplaces develop into extra widespread,” Ms Rossi instructed information.com.au.

“With a wider number of gadgets out there, it appears scammers may additionally see a chance. Financial downturns might additional gas this concern, doubtlessly driving extra folks to purchase and promote on-line, creating a bigger target market for these scams.

“I’ve seen a rise in approaches from customers on Fb Market with new or incomplete profiles, typically providing instant cost through PayID with out inspecting the merchandise or asking detailed questions. These purple flags counsel potential scams.”

‘My brother is coming’

A number of current sellers information.com.au spoke to all reported being inundated with seemingly reputable messages from folks inquiring a few product, asking a number of primary questions, after which asking to make use of PayID.

Whereas PayID is a reputable type of digital cost, it’s more and more being utilized by scammers as a solution to commit fraud.

Sellers are instructed {that a} relative will then come to gather the merchandise on their behalf, however they by no means present and those that fall for it have their cash swindled.

“I had about 12 of these messages,” one pissed off vendor mentioned.

“I simply needed to do away with my sofa. I spent half a day f***ing round with scammers. They appear legit and then you definately shuttle, then the ‘relative’ and the PayID bit comes and it’s like, oh God, one other one.

“In the long run, I’d had sufficient so I simply dumped the sofa out the entrance of my home and booked a council pick-up. F*** Fb Market.”

Cassandra Cross, Affiliate Dean at Queensland College of Know-how’s School of Inventive Industries, Training and Social Justice, Queensland College of Know-how, mentioned there are some purple flags.

“They often won’t query the worth, and they’re unlikely to even need to view the merchandise,” Dr Cross mentioned.

“In lots of instances, they’ll say a member of the family or good friend will acquire it from you.

“The offender will then urge you to just accept cost via PayID. When you’ve shared your PayID – often telephone quantity or electronic mail deal with – and the scammer has this info, a number of issues might occur.”

The scammer might declare they’ve despatched the cost, however it could actually’t be processed as a result of the vendor wants an acceptable PayID account.

“You may be instructed you both must ‘improve’ the account and/or make an extra cost to launch the funds. The offender will then say they’ve paid the additional quantity required and ask you to reimburse the extra funds they’ve spent.

“In case you do switch any cash, it’ll go straight to the scammer and be misplaced.”

It’s doubtless the scammer will present screenshots of faux textual content messages or electronic mail confirmations, purporting to be from PayID or a financial institution, confirming the problem, she mentioned.

“Scarily, such messages might even seem in an current SMS thread along with your financial institution. Chances are you’ll suppose they’re real, however they’re faux, designed to deceive you into transferring cash to the offender.”

One prolific Fb consumer instructed information.com.au she had reported a mammoth quantity of rip-off accounts however seen minimal motion by the platform.

Most of her studies have been returned with a message that the grievance had been reviewed however deemed clear, regardless of clear indicators of scammer exercise.

Loads getting stung

Regardless of how prevalent this model of rip-off appears to be, many Australians are getting stung.

Analysis by monetary comparability web site finder.com.au indicated that one-in-10 market customers have been duped.

That’s the equal of two million Aussies, who’ve misplaced an estimated $500 every on common prior to now 12 months.

ScamWatch, a part of the Australian Competitors and Client Fee, acquired a complete of 1944 studies referring to on-line market scams utilizing PayID, with losses totalling $778,315.

That’s greater than triple the quantity fleeced from sellers in 2022, when losses hit $260,000.

Angus Kidman, cash professional at finder.ocm.au, mentioned 15 per cent of Fb Market customers, or about three million folks, reporting being focused however noticed to con and walked away.

“There’s lots of people doing it robust who’re promoting undesirable gadgets to make some spare money,” Mr Kidman mentioned. “However as an alternative of a money injection, unsuspecting Aussies are falling sufferer to fraudsters.

“It doesn’t matter what sort of stuff you’re promoting – whether or not it’s video consoles or caravans – criminals will attempt to make the most of sellers.”

In a press release, Meta, which owns Fb, mentioned it continues to work the Nationwide Anti-Rip-off Centre and throughout industries to seek out new methods to fight scammers.

“Scammers current a problem in lots of environments, together with social media, and they’re continually discovering new methods to deceive folks,” a spokesperson mentioned.

“Meta adopts a multifaceted method to deal with scams. We use each know-how, corresponding to new machine studying methods, and specifically educated reviewers to establish and motion content material and accounts that violate our insurance policies.”

Within the last three months of 2023 alone, Meta expunged 691 million faux accounts globally throughout its platforms.

“We additionally put money into instruments on our providers that permit folks to report scams and to warn folks if they’re contacted by somebody they don’t know. We associate with native organisations to teach shoppers to identify and keep away from scams and convey enforcement motion in opposition to scammers.”

Providing another

Kylie Wallace has been buying and selling, promoting and thrifting issues since she was a child – a interest that advanced into her serving to family and friends offload their undesirable items.

It then sparked a enterprise concept – Upcycle – which she launched in early 2023 with buddies Elliot Costello and Sheena Boys.

Somebody with stuff to unload registers, the Upcycle group visits their residence or storage shed to itemise and {photograph} every little thing, then they record and promote it through on-line marketplaces, managing pick-up and cost.

“Australians need to do their bit to scale back their waste, recycle family merchandise and lighten their influence on the planet however they’re time poor and fearful about being scammed,” Ms Wallace mentioned.

“Upcycle is the right resolution to this rising downside. The second-hand financial system is value roughly $60 billion and the common Aussie households are holding onto $7000 value of sellable gadgets.”

She’s been shocked by a few of her buyer’s horror tales about “how rampant scamming is on marketplaces on-line”.

“Individuals have expressed how initially it was very easy to identify the scammers however these days it’s a lot more durable to inform the actual from the faux consumers,” she mentioned.

“Our clients have instructed us that they’ve wasted a lot time replying to so many messages about gadgets solely to seek out that half of the folks they have been messaging have been scammers.”

Even Ms Wallace and her aspect hustle companions are commonly focused, however they know the indicators to search for and haven’t been stung.

Is the rip-off evolving?

Information.com.au heard from one vendor who commonly makes use of Fb Market and has seen a slight shift within the PayID rip-off.

Medical psychologist Rik Schnabel mentioned the tried con begins the identical manner because it has for months now.

“Usually, they arrive fairly rapidly after itemizing one thing on the location – in order that they should have a hack or bot that tells them when one thing new is listed,” Mr Schnabel mentioned.

“They often say pretty quick that they need to purchase the merchandise and say that their brother or sister will come to select it up.”

However as an alternative of PayID, he has been directed by the scammers to an app that claims to have the ability to ‘wire’ the cash immediately from purchaser to vendor.

“I haven’t accepted any one in every of them, so I’m undecided what occurs subsequent,” he mentioned.

And in different dodgy cases, PayPal is obtainable as the strategy of cost by consumers who’re longing for a fast transaction.