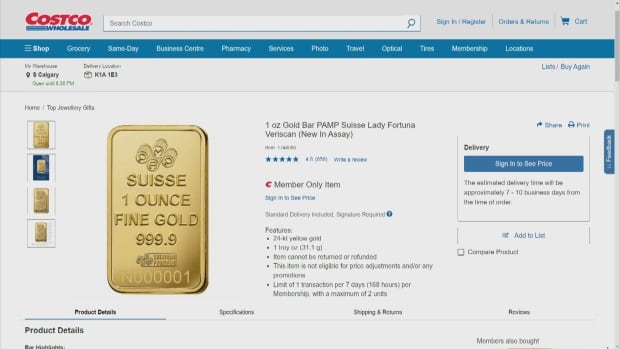

Warehouse shops in Canada aren’t simply promoting giant portions of bathroom paper nowadays — gold bars and cash and different valuable metals are transferring out of the realm of banking and jewellers and into their aisles.

With gold hitting record-high costs in current weeks, the steel’s reputation has been mirrored at retailers, too.

In accordance with Costco’s chief monetary officer, Richard Galanti, the corporate “bought over $100 million [US] of gold” throughout a current 12-week interval. Walmart has additionally began promoting gold, silver and platinum bars on-line to U.S. customers.

Costco did not reply to requests for remark from CBC Information, however officers had beforehand instructed buyers their gold bars would promote out inside hours of being listed on-line.

Cultural and monetary worth

Richmond Hill, Ont., resident Erfan Hashempour has invested in gold and silver over the previous few years by buying cash, as a result of they’re simpler to deal with and to accumulate by the Royal Canadian Mint. He was stunned to see gold bars and gold cash obtainable at his native Costco warehouse.

“The rest, yeah, you’d count on to see it in Costco, however probably not gold,” he mentioned.

For buyers like Hashempour, gold is each a cultural and a monetary funding.

“Initially, I am from Iran. And in our tradition, gold has all the time had significance,” defined Hashempour.

He is been investing in particular valuable metals to diversify his monetary and funding portfolio. It is also a method to tackle issues that currencies and different stock-type investments could be much less steady in the long run.

“I’ve all the time gotten this recommendation from my mother and father and from members of the family, to spend money on valuable metals akin to gold and silver as a result of it is not one thing that depreciates [like] Iranian cash over the previous 40 years,” he mentioned.

A ‘hedge’ in opposition to instability

That is a standard motivation for these investing in gold, in line with valuable metals supplier Jonathan Rose — they’re nervous about how conventional currencies or shares are performing, and gold has a confirmed observe document as a steady funding.

“People who find themselves on the lookout for a hedge take a look at valuable metals,” mentioned Rose, who’s with Genesis Gold Group in Beverly Hills, Calif.

Gold has lengthy been seen as a steady funding, and at a time of worldwide uncertainty, it’s turning into so common that large field shops akin to Costco have jumped on the bandwagon.

He provides that different elements, such because the volatility of newer cryptocurrencies and the fluctuating worth of the U.S. greenback, drive individuals to what he calls “tangible” wealth — bodily belongings akin to gold or silver.

“Any time there’s geopolitical, worldwide instability, individuals are on the lookout for a protected haven or a flight to security and safety,” he instructed CBC Information.

To be fairly trustworthy, [gold investors] imagine that the world’s most likely going to go to hell in a handbasket.– David Wagner, Aptus Capital Advisors

Nonetheless, portfolio supervisor David Wagner says gold doesn’t all the time hedge in opposition to monetary phenomena akin to inflation, and that gold buyers are typically performing out of worry.

“They’re attempting to personal gold in the event that they imagine that there is going to be some kind of debasement of the U.S. foreign money,” mentioned Wagner, who’s with Aptus Capital Advisors in Cincinnati, Ohio.

“To be fairly trustworthy, they imagine that the world’s most likely going to go to hell in a handbasket.”

Gold actually feels reliable to some

Wagner’s perspective is that many gold buyers put extra belief in an funding they will see, really feel and maintain of their fingers. However he additionally says this may occasionally give them a flawed sense of safety for a similar purpose: bodily investments may be misplaced or stolen.

“[If] somebody involves your home and tries to rob you, you’ll be able to inform them, ‘I am protected, I personal gold,'” he instructed CBC Information.

“What are they going to most likely do? They’re most likely going to rob you and take your gold.”

That form of concern would not do a lot to maneuver gold buyers like Hashempour.

“I really feel like gold is a protected guess for funding … whereas with shares, issues might go sideways for firms that you simply purchase shares from,” he identified.

However he mentioned he does maintain many typical inventory and foreign money investments, and is not maintaining all of his eggs — golden or not — in a single basket.