The variety of enterprise insolvencies surged to its highest stage since 2015 within the three months to September 30, with development business collapses main the way in which.

The information, from the Australian Securities and Investments Fee (ASIC) reveals that 2486 companies hit the wall over the last quarter.

It’s the most important variety of insolvencies reported in a single quarter because the December 2015 quarter, when 2499 companies collapsed.

Of the collapses within the September quarter, 783 of them – or 31 per cent – had been within the development business.

For a similar quarter in 2022, 605 development companies failed, whereas the September quarter of 2021 booked simply 238 development failures.

Liquidator Nicholas Crouch, from insolvency agency Crouch Amirbeaggi, advised information.com.au that he was “not shocked” that insolvencies within the development sector had leapt over the previous two years.

He stated the lots of of billions in Covid-19 stimulus pumped into the economic system by the Australian authorities helped prop up struggling enterprise and resulted in lengthy delays between an bancrupt occasion and liquidators being known as in, as enterprise house owners tried to hold on.

Throughout Covid, the federal government relaxed the brink for collectors to situation statutory calls for for fee and the time frames for companies to reply to statutory calls for for fee.

Administrators had been additionally launched from any private legal responsibility for buying and selling whereas bancrupt throughout that point, and insolvencies fell dramatically.

Mr Crouch described the scale of the pandemic stimulus as “unhealthy financial administration” and stated that the federal government “obtained it improper”.

He stated that the upper rate of interest atmosphere meant it was unlikely that the ache was over for the constructing sector.

“Building is getting completely hammered by rates of interest,” he advised information.com.au.

Mr Crouch added that when the relaxed guidelines and added stimulus throughout Covid mixed with “historic low rates of interest that had been out of kilter with the actual stage of financial misery” the uptick in insolvencies was inevitable.

“You possibly can’t have zero per cent rates of interest and never count on penalties. You possibly can’t have an excessive amount of sugar and never count on a crash.”

The woes within the constructing business are additionally taking a toll on a few of Australia’s largest builders.

Australia’s second-biggest personal development agency, Hutchinson Builders, as we speak introduced a 93 per cent fall in internet income for the 2022-23 monetary 12 months.

Earlier this 12 months chairman Scott Hutchinson advised The Australian: “It’s been very onerous work and we’ve simply needed to battle it out.”

“We haven’t had an excellent 12 months since 2017. What’s killing us is the rain and the truth that we will’t get supplies and labour. It’s not sustainable and that’s the reason so many people are going broke. We’re hoping 2024 will probably be higher.”

The ASIC knowledge reveals that the variety of development companies that went into exterior administration within the September quarter was greater than double that of another business, and 27 per cent increased than within the June quarter.

CEO of credit score reporting company CreditorWatch, Patrick Coghlan, advised information.com.au that development business insolvencies had now surged above pre-Covid ranges.

Mr Coghlan stated that builders had been “hammered from a number of fronts” together with provide chain points and inflation affecting the fee and availability of supplies, labour shortages affecting the fee and availability of labour and excessive rates of interest affecting demand for development initiatives.

A squeeze on the margins of small to medium residential builders working to mounted fee contracts had additionally performed a task.

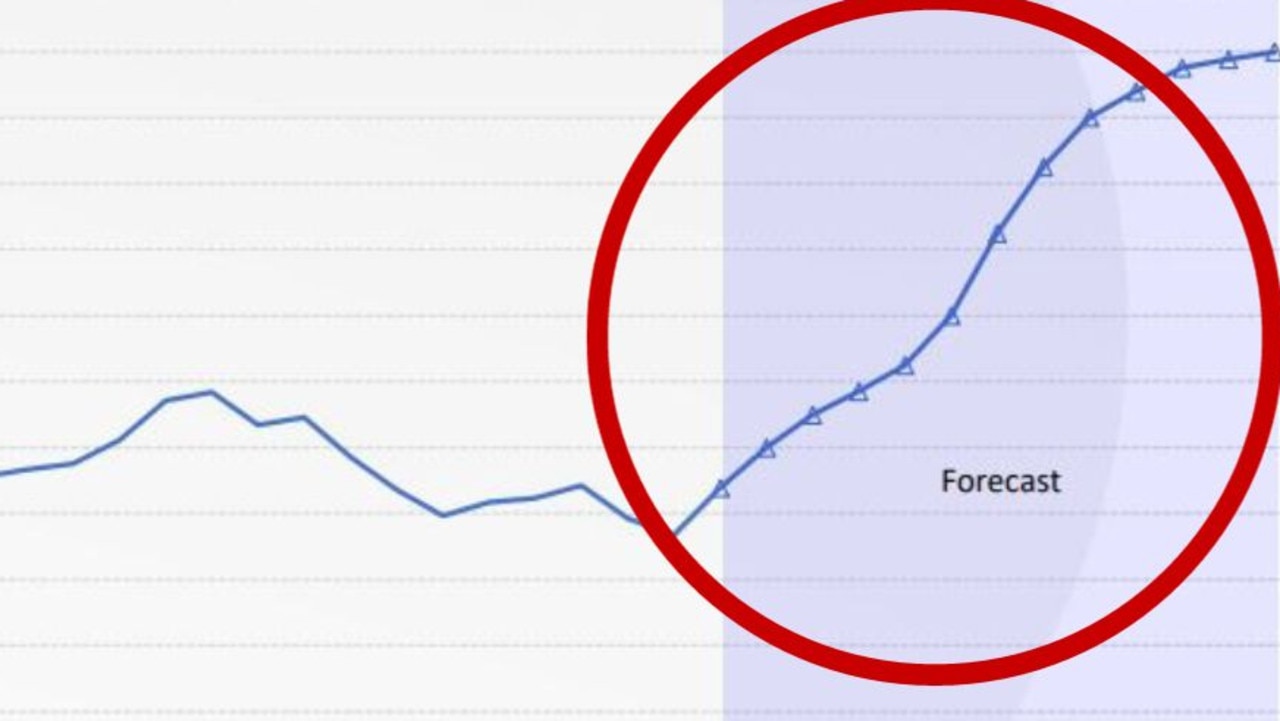

Mr Coghlan advised information.com.au that he anticipated the general variety of enterprise insolvencies to proceed to extend, together with these within the development sector.

CreditorWatch’s month-to-month Enterprise Threat Index forecasts that enterprise failures are prone to proceed to rise over the following 12 months, from the present fee of 4.5 per cent to five.8 per cent.

“Let’s see what occurs if there’s one other rate of interest rise subsequent month,” he stated.

Over the previous 12 months, information.com.au has reported on dozens of constructing business collapses.

Snowdon Developments, Probuild, Porter Davis and Hotondo Houses are amongst a few of the largest development companies to have failed.