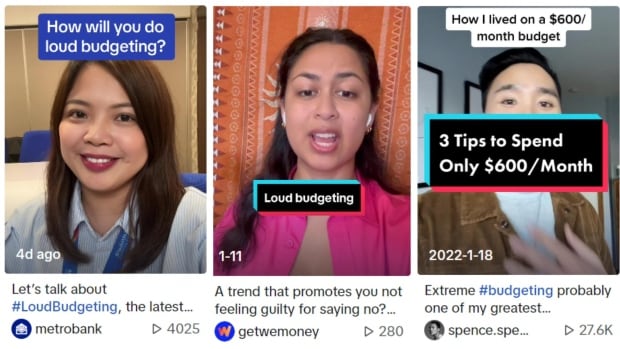

Transfer over “lady math” and “quiet luxurious,” a brand new private finance pattern is taking off on TikTok.

Social media customers are embracing “loud budgeting,” an idea that went viral after TikToker Lukas Battle talked about it as one thing he is beginning in 2024.

Now, simply three weeks into the yr, #loudbudgeting has greater than 10 million views on TikTok.

What’s loud budgeting?

Very like the title implies, loud budgeting is a monetary technique that emphasizes being vocal about your bills and monetary scenario. Monetary accountability, if you’ll.

“It isn’t ‘I haven’t got sufficient,’ it is ‘I do not wish to spend,'” stated Battle in his video clarification. He describes it as “the other of quiet luxurious,” referring to a social media pattern final yr that concerned a extra delicate expression of your wealth via high-quality merchandise that did not function logos.

“[Loud budgeting] is all about speaking about your private finance and guaranteeing that you’re advocating for your self, particularly in conditions the place typically you might not be an avid advocate,” stated Zainab Williams, a licensed monetary planner with Elleverity Wealth Administration.

The idea is taking maintain at a time when rising prices are high of thoughts for a lot of Canadians.

Canada’s annual inflation fee jumped to three.4 per cent in December, in accordance with knowledge from Statistics Canada launched earlier this month. Airfares, gas, passenger automobiles and hire had been among the key contributors to the rise. The report additionally discovered that costs for meals bought from shops rose 4.7 per cent in comparison with the identical time final yr.

After backlash from buyers, Loblaw says it is going to return to discounting merchandise by 50 per cent after they’re about to run out. The corporate stated it ‘listened to the suggestions from our prospects and colleagues’ after revealing final week the low cost would drop to 30 per cent.

And whereas the pattern of tighter budgeting and assembly monetary targets is resonating with a number of younger individuals as one thing new, for some, it is a longtime lifestyle already.

The philosophy is one thing that is been a longtime behavior for Reilly O’Connor, a Canadian content material creator. O’Connor who’s additionally an early childhood educator, has a number of movies on social media describing what she calls a “reasonable day within the life,” the place she highlights issues like budgeting and affording what she calls “primary dwelling means.”

“We do not receives a commission sufficient … so we simply routinely should make cuts and prices,” stated O’Connor.

Couponing, discovering offers whereas grocery buying, consuming out at eating places much less and cancelling her fitness center membership are just a few examples of budgeting O’Connor stated she’s been vocal about on her TikTok.

“I needed to point out a means that we are able to nonetheless reside a contented life. Everyone has targets, however we are able to nonetheless be completely happy whereas we’re making an attempt to make these targets,” she added.

WATCH | Reilly O’Connor on a ‘reasonable day within the life’:

O’Connor stated loud budgeting has not solely led to concrete financial savings however has additionally been empowering for her.

“The second that you simply’re reasonable and open about your monetary standing, the better it will get and the much less of a burden it should be, and the much less you are going to really feel your self evaluating your self to others.”

“I believe it is actually helped simply hold me accountable,” she added.

Williams agrees that loud budgeting could be empowering for some individuals.

“The actually beauty of social media is the truth that it exposes us to varied concepts … whether or not it is to advocate for ourselves, on the subject of our cash, tales, whether or not it is to know the forms of questions you could be asking your monetary adviser, or any suggestions and methods on how you need to be saving cash,” she stated.

However on the similar time, social media developments like this may create a way of strain for some individuals to take part in one thing that may not be proper for his or her scenario, in accordance with Williams.

“It is actually a matter of being actually true to your self, slightly than entering into feeling pressured to behave in a sure method.”

Finance developments and social media

Loud budgeting is not the primary finance-related pattern to achieve traction via social media. The aforementioned lady math and quiet luxurious are each examples of social media developments centred round cash.

O’Connor says shops like TikTok have been useful for a way she manages her personal funds.

“It created a assist system in a protected place on the web the place different individuals may share their suggestions and methods as properly.”

Collaborating in developments on-line, particularly along with your cash, comes all the way down to what you are snug with, in accordance with Williams.

“Cash is such a private factor to us. It could set off several types of feelings in us whether or not it is disgrace, whether or not it is a feeling of satisfaction, since you’ve achieved one thing.”

Crucial factor is being sensible about what you are consuming on-line, in accordance with Williams.

“It is essential to examine in and actually consider what precisely you are consuming and the way that consumption goes to be impacting you down the road.”