A co-founder of FTX testified in front of a judge that Sam Bankman-Fried’s tweet in which he assured his followers that the cryptocurrency exchange was “fine” was untrue.

Gary Wang, a former executive at the company, claims that when Mr. Bankman-Fried made the post, he was aware that the company was facing a hole of $8 billion. After many days, it filed for bankruptcy.

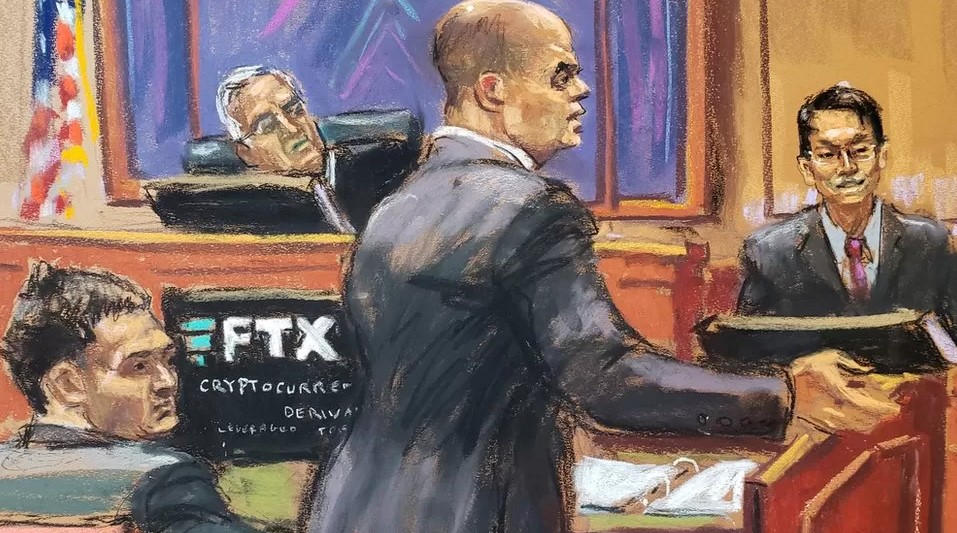

Mr. Wang was testifying in the courtroom in New York, which is where the case against Mr. Bankman-Fried is being heard.

Mr. Wang has previously entered a guilty plea.

The 30-year-old man, a friend from high school math camp who later became chief technology officer at FTX, took the witness for a second day on Friday, answering questions about spreadsheets, tweets, and private chats as prosecutors investigated the discrepancy between the firm’s public face and its inner workings.

Mr. Wang asserted that Mr. Bankman-Fried had regularly misled the public regarding the state of the company’s finances by making statements that were made in public that were not founded on fact.

“FTX was not fine,” stated Mr. Wang. “Assets were not fine, because FTX did not have enough assets for customer withdrawals.”

In November of the previous year, FTX was forced to declare bankruptcy due to the overwhelming number of customers who attempted to withdraw their funds.

Soon after that, Mr. Bankman-Fried was accused of fraud, money laundering, taking money from FTX customers, and lying to investors and lenders. These allegations were brought against him shortly after. He has refuted the allegations that have been made against him.

The Department of Justice has made allegations that he used the crypto trading company that Mr. Bankman-Fried had formed a few years earlier, Alameda, to launder the funds of his clients and use them for things such as marketing, political donations, real estate acquisitions, and other expenditures.

In his statement before the court, Mr. Wang stated that “we said publicly that we would not use customer funds in such a way.”

Mr. Wang stated that he and Mr. Bankman-Fried had a conversation about the gradually developing hole on the company’s financial sheet, which was caused by huge withdrawals of customer monies by Alameda. This took place prior to the collapse of FTX.

According to him, Alameda was already making withdrawals that were greater than what FTX brought in from fees imposed to customers trading on its platform by the time 2019 came to a close.

The court was informed that by June 2022, Mr. Bankman-Fried had requested a review of Alameda’s indebtedness to FTX. This left top executives discussing through spreadsheet how to compute the accurate total amount of debt. During that month, Mr. Wang estimated that number to be close to $11 billion.

Despite what the general public may believe, he stated that the Alameda account included characteristics that set it apart as being one of a kind. These characteristics included the ability to run a negative balance and a credit line of $65 billion at FTX.

In one case in 2019, Mr. Bankman-Fried claimed on Twitter that his trading firm, Alameda, had an account on the exchange that was “just like everyone else’s.” This was a few months after he had started FTX.

According to Mr. Wang, on the same day, Mr. Bankman-Fried instructed him to modify the coding for the platform so that Alameda may withdraw a limitless amount of money.

In another instance, the CEO of FTX wrote about the amount of money that was stored in a fund that was designed to protect in the event of losses, but the amount that he posted was a “fake number,” as described by the prosecution.

Everdell Christian, if you will. Before the court session was through for the day, the attorney representing Mr. Bankman-Fried only had a little over an hour to cross-examine Mr. Wang.

He hypothesized that the distinctive qualities of Alameda’s account were the result of the company’s function as a “market-maker” on the platform, which meant that it was responsible for ensuring that trading went off without a hitch.

The duration of the experiment is anticipated to be six weeks. Next week, Mr. Wang will continue to testify, and then the prosecution will call Caroline Ellison to the stand. Ellison is the ex-girlfriend of Mr. Bankman-Fried and the ex-chief executive officer of Alameda. She has also pleaded guilty.